2023 Legislative Update 9

Week of March 1 to March 3, 2023

Week 9 in the Kansas House was a flurry. House Democrats hosted press conferences covering education funding, special education, teacher pay, and property tax cuts, demanding that Republicans pivot their focus from culture war divides to kitchen-table issues.

The Wyandotte County Delegation’s weekly luncheon this week included a very informative presentation by McClain Bryant Macklin, VP Policy and Impact, Health Forward Foundation, about the work they do in our community. Their mission is “to achieve health equity and secure a fair and just region.” The work they do to support that varies from addressing health access to voter rights. Health Forward uses creative approachs to address health inequities and social determinants of health and supports a holistic view as to what it takes to build a healthy community. Many thanks to McClain Bryant Macklin, Nathan Madden and Alicia Araujo for joining the Wyandotte County Delegation for our lunch and learn at the Capitol. You can learn more about Health Forward at healthforward.org.

Frank White III, President and CEO for the Kansas City Area Transportation Authority “KCATA” provided a briefing to the House Transportation Committee. It was so nice to see both Frank and Terri Barr-Moore at the Capitol. Since my usual committee did not meet that day, I was able to see my friend Frank give an excellent presentation to House Transportation. There were several questions from committee members about micro transit as well as future expansion plans, including potential for rail and connections to the airport.

It is a special honor to serve as your state representative. I value and appreciate your input on issues facing state government. Please feel free to contact me with your comments and questions. My office address is Room 452-S, 300 SW 10th, Topeka, KS 66612. You can reach me at (785) 296-7430 or call the legislative hotline at (800) 432-3924 to leave a message for me. You can also e-mail me at pam.curtis@house.ks.gov.

K-12 Education Committee

Immediately after Monday’s K-12 Education Budget meeting, the Democrats hosted a press conference. In the committee, the Republican Chair and Vice Chair insisted on combining special education funding and teacher pay raises with a controversial voucher bill to urge support among reluctant lawmakers.

It was also announced that under the bill, Kansans making 600% of the federal poverty level will qualify for vouchers. This means any family making up to $180,000 may apply for and receive taxpayer money to send their kids to private, parochial, or home schools.

The move puts lawmakers in a difficult position.

Rep. Jarrod Ousley attempted to sever the popular aspects of the legislation from vouchers, but the GOP majority struck down the motion. The motion would have allowed representatives to support special education funding and teacher pay raises without voting for vouchers.

“Our teachers deserve more,” he said. “They deserve everything they’ve earned, and that’s probably not what they’re getting — whether it’s respect in the classroom, respect in the committee room or their salary schedule.”

Assistant Democratic Leader Rep. Valdenia Winn, hit on the committee’s egregious, repeated breaches of public trust throughout the 2023 session. “Do public servants silence opposition? Do they amplify misinformation?” Winn said “I’m constantly concerned about achievement, but I don’t attack the teachers. I don’t try to take funding from public schools. The whole process was disingenuous, which is a word that we use up here for not telling the truth, for telling lies.”

Teachers spoke up on social media and in-person about the scheme, saying they’d rather skip out on pay hikes than suck much-needed funding out of classrooms. Then, more than 100 of Kansas’s “most distinguished” teachers and educators -- including 2022 Kansas Teacher of the Year Susanne Stevenson, 2020 National Teacher of the Year Tabatha Rosproy, 2019 Kansas Teacher of the Year Whitney Morgan, and 2018 Kansas Teacher of the Year Sam Neill -- signed onto a letter rejecting so-called school choice and voucher scams.

They wrote, “We believe that accredited private schools and homeschools have an important role in the education of children; however, we do not support using public funds for private education.” Read the full letter

here.

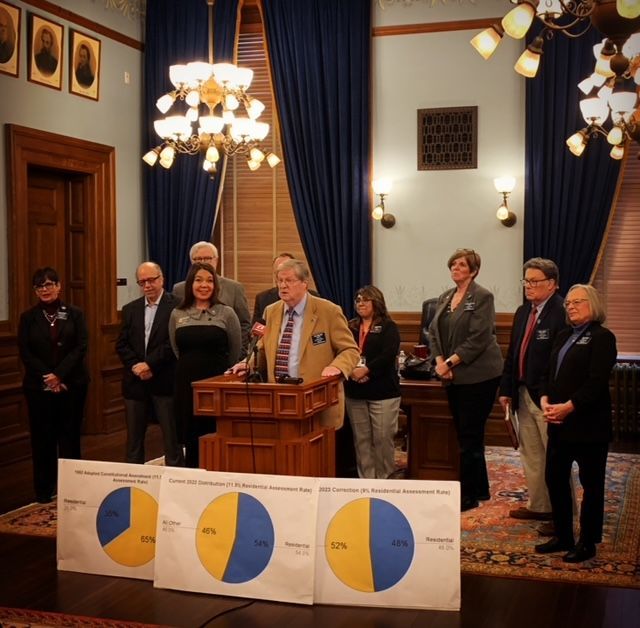

Property Tax Cut Proposal

Homeowners across Kansas are reacting with concern this week to property valuation notices. With some areas of Kansas seeing home valuations spike by upwards of 25% and 30%, there is a very serious reality that some families will be taxed out of their homes.

According to the Market Study Analysis for Wyandotte County the “residential market indicates a median inflationary trend of 20% over the course of 2022”. The study states: “High demand, and low supply continue to drive demand for residential property within Wyandotte County. These factors have led to an increase of sales prices and subsequently an increase in market values.”

At a press conference this week House Democratic Vic Miller said "That's why we're here making noise. We're hearing the noise from the people, but we're not hearing enough noise in this building about the problem of rising property taxes."

Some averages from across the state:

- Wyandotte County saw a 20% increase

- Shawnee County saw a 13% increase

- Johnson County saw a 12% increase

- Douglas County saw a 9% increase

- Leavenworth County saw a 14.8% increase

- Wallace County saw a 20% increase

House Democrats again urged the Kansas Legislature to

at least have hearings on the following three-pronged property tax proposal, which eases the property tax burden on homeowners:

- HCR 5009: A constitutional amendment reducing the assessment level of Residential Property from 11.5% to 9%. Even with this reduction, residential property will still contribute an estimated 48% of the total property taxes in the state.

- HB 2366: Replenish and enhance the Local Ad Valorem Tax Reduction Fund (LAVTRF). We propose that the LAVTRF be replenished with the annual $54,000,000 required by law (K.S.A. 79-2959) and, for the next four years, enhanced by an equal annual amount of $54,000,000.

- HB 2364: Amend K.S.A. 79-201x to raise the residential property exemption from the statewide school mill levy to $65,000. We propose raising this exemption again—this time from $40,000 to $65,000. The fiscal note for this is $55.6 million in FY 2025, $62.3 million in FY 2026, and $62.3 million in FY 2027.

Rep. Adam Smith, chairman of the House Taxation Committee, agreed on Tuesday to host a hearing over HCR 5009. "We agree on a lot more than we disagree on," he told

The Capital-Journal

after the press conference. "I would love to sit down with him, and I'm sure I will here soon."

HCR 5009 amends the Kansas Constitution to reduce residential property assessment levels from 11.5% to 9%. Homeowners are estimated to save nearly $700 million under the change. There would not be a reduction in tax revenues. The amendment would simply shift some of the burden off residential property and onto other classes, such as agriculture, oil and commercial.

"We cannot continue this pattern. We have to do something about it, or we're going to tax people out of homeownership,” said Miller.

If passed out of committee, the constitutional amendment would require a ⅔ vote of the body. If it received the necessary 84 votes, voters would see the question on their next ballot. To pass, the amendment needs a simple majority of the vote.

The hearing on HCR 5009 is to be held on Thursday, March 16th.

House Democrats encourage homeowners to submit testimony supporting the amendment to the Tax committee. You may find instructions to provide either written or oral testimony by contacting Rep. Smith’s office at 785 296-0715 or

adam.smith@house.ks.gov.

Across the Rotunda

In the Senate chamber, focus was on the transgender athlete’s bill. After a floor debate and failed amendments, HB 2238 passed on a 28-11 vote. The House passed the bill earlier in the session, 82-40, two votes short of the ⅔ majority needed to override a gubernatorial veto.

Now that both chambers have passed the bill, it heads to Governor Laura Kelly’s desk. She’s historically vetoed the legislation as have numerous Republican governors.

SUBMIT TESTIMONY: High Hopes for Medical Cannabis Bill

The Senate Committee on Fed & State Affairs will host a hearing on a medical cannabis bill, SB 135. Kansans are encouraged to submit testimony in support of legalizing medical use of cannabis, and contact their legislators to push for legalization.

Individuals wishing to present testimony before the Committee must provide a digital copy of the testimony by email, in PDF format, to the committee assistant (Sheila.Wodtke@senate.ks.gov) at least 24 business hours in advance of the hearing. This means testimony on SB 135 must be submitted by 10:30 A.M. on Wednesday, March 15.

Find full instructions to submit testimony, including formatting recommendations, here.

Rally for KanCare Expansion

Join Alliance for a Healthy Kansas and other Medicaid expansion advocates for a rally in the Capitol building on March 15th! Don’t live in Topeka? No problem. Buses are leaving from Wichita, North Newton, and Emporia on the morning of the rally. RSVP

here.

Views From the House Floor

HB 2002: Continuing in existence the reimbursement from the taxpayer notification costs fund for printing and postage costs for county clerks beyond calendar year 2023. Emergency Final Action - Passed, 114-7.- HB 2021: Allowing evidence-based program account money to be used on certain children, requiring the department of corrections to build data systems and allowing for overall case length limit extensions for certain juvenile offenders. Final Action - Passed as Amended, 85-35.

- HB 2229: Providing a deduction from sales or compensating use tax when selling and buying different motor vehicles within 180 days. Emergency Final Action - Passed, 117-4.

- HB 2106: Providing a sales tax exemption for sales of property and services used in the provision of communications services. Emergency Final Action - Passed as Amended, 108-13.

- HB 2026: Requiring the secretary of revenue to file release of tax warrants in the county where the warrant is docketed after payment of taxes owed. Emergency Final Action - Passed as Amended, 121-0.

- HB 2304: Standardizing firearms safety programs in school districts. Final Action - Passed, 78-43.

- HB 2201: Requiring prior year tax information to be included on the classification and appraised valuation notice. Emergency Final Action - Passed, 121-0.

- HB 2344: Expanding the membership of the council on travel and tourism, updating the committee assignment required for members appointed from the house of representatives and modifying the department of commerce's grant program for tourism promotion by reducing the allocation of grants for public entities and removing the limitation on grant amounts to any single entity. Final Action - Passed, 114-9.

- HB 2144: Authorizing modification of a noncharitable irrevocable trust to provide that the rule against perpetuities is inapplicable, providing that the Kansas uniform statutory rule against perpetuities is inapplicable to trusts under certain circumstances and modifying the definition of resident trust in the Kansas income tax act. Final Action - Passed, 123-0.

- HB 2083: Creating the Kansas vacant property act to prohibit municipalities from imposing any fees or registration requirements on the basis that property is unoccupied. Final Action - Passed as Amended, 87-36.

- Sub HB 2077: Implementing additional reporting requirements for information technology projects and state agencies, requiring additional information technology security training and status reports, requiring reporting of significant cybersecurity audits and changing the membership requirements, terms of members and the quorum requirements for the information technology executive council. Final Action - Substitute passed as amended, 123-0.

- HCR 5005: Making application to the Congress of the United States to call a convention of the states to establish term limits for members of Congress. Final Action - Not adopted by required ⅔ majority,

69-54.

Contact Rep. Pam Curtis

Thank you for reaching out. Please allow 48 to 72 hours for Rep. Curtis to respond to your communication.

Oops, there was an error sending your message.

Please try again later, or email Rep. Curtis directly at info@curtisforkck.com.